3. Strategy

In campaigning, the OTT-competition (Netflix, Streamz…) focuses exclusively on the content they offer. As the options for content consumption for today's customers are endless, we shift our focus from the offered content to our own added value, with full eye for our consumer. Two main insights lead us to a strategic direction that is inspired by the unmet needs of the TV consumer anno 2021.

Insight 1: brand relationship/familiarity

Research shows that new OTT and DTV platforms gain in awareness, but not in familiarity (except for Netflix). The presence of recurring familiar faces on a tv channel (presenters, news readers…) creates this familiarity. We want to fill in the need for familiarity again.

Insight 2: choice paralysis

44% of Belgian content consumers have a subscription to more than one streaming platform (free content providers disregarded), bringing an amount of content to people that's increasingly difficult to choose from (FOBO - Fear Of Better Options). Research shows that 4 out of 10 streaming consumers sometimes give up when looking for something to watch.

Strategic Core Idea

We revitalize & strengthen the 2019 Pickx value proposition for the TV consumer of 2021. We put forward a strong and unique brand promise focusing on both Pickx's large offer and its curating role. A best of both worlds: you have all the options, without the choice paralysis.

Creative Strategy

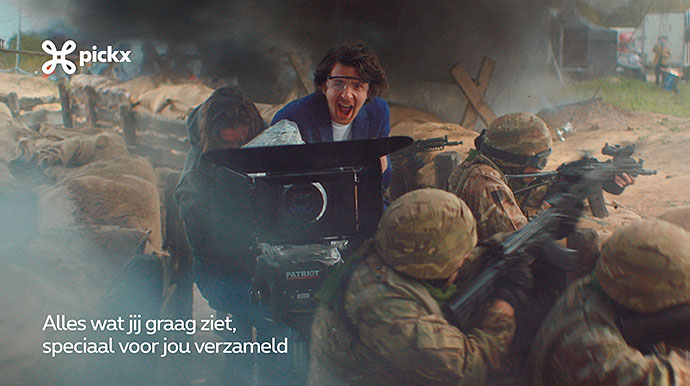

What could generate the familiarity we feel for traditional TV channels, caused by familiar faces? The answer is simple: a familiar face. We bring the strategic idea to life with a 'brand character' as a distinctive asset.

We personalise Pickx into a recognisable human being, always right in the center of our communication, presenting you: Mr. Pickx. He is the embodiement of the Pickx value proposition: an amiable character, at home in all content contexts, that explains in a very easy & direct way, and in spoken language, this curating role of our brand promise: 'Jo will find that fantastic'.

We let Mr. Pickx walk through 4 content types that would likely gather interest of new consumers within our target group: entertainment, music, content for children and sports. Since the UEFA European Football Championship is taking place in 2021, we show footage of our Red Devils and strategically let our campaign partially overlap with this period (June and July). This way, we attract football lovers, who then could discover other types of content as well.

|

Na zijn eerste ervaringen met social media en digitale communicatie, marketing en customer service bij Engie Group, startte Steven als expert in media en content bij BMW Belux. Om dan als Brand Communication Manager BMW op de nummer 1 positie in het premium segment te brengen en houden. Bij de overstap naar Proximus in 2020, omvatte Stevens rol alle media-aspecten van de Proximus Group. Vandaag leidt hij het Competence Center Brand, Communication & Media, waar de missie is om 'the most loved brands in Belgian Telco' te bouwen, elk met een unieke merkidentiteit en communicatieaanpak.

Na zijn eerste ervaringen met social media en digitale communicatie, marketing en customer service bij Engie Group, startte Steven als expert in media en content bij BMW Belux. Om dan als Brand Communication Manager BMW op de nummer 1 positie in het premium segment te brengen en houden. Bij de overstap naar Proximus in 2020, omvatte Stevens rol alle media-aspecten van de Proximus Group. Vandaag leidt hij het Competence Center Brand, Communication & Media, waar de missie is om 'the most loved brands in Belgian Telco' te bouwen, elk met een unieke merkidentiteit en communicatieaanpak. Dominique ontwikkelde tijdens zijn studies Architectuur (St Lukas Brussel) en Communicatiewetenschappen (VUB) een neus voor strategische analyse & creatieve intuïtie. Die combinatie leidde hem in 2000 naar de reclamewereld waar hij als strateeg in zowel merkstrategische (TBWA, DDB) als digitale agencies (Boondoggle, Accenture Song) werkte. Vandaag bouwt hij als Head of Strategy bij FamousGrey in nauw overleg met creatieven, designers & technologische experts aan slimme merkstrategieën die recht op doel afgaan qua impact & effectiviteit.

Dominique ontwikkelde tijdens zijn studies Architectuur (St Lukas Brussel) en Communicatiewetenschappen (VUB) een neus voor strategische analyse & creatieve intuïtie. Die combinatie leidde hem in 2000 naar de reclamewereld waar hij als strateeg in zowel merkstrategische (TBWA, DDB) als digitale agencies (Boondoggle, Accenture Song) werkte. Vandaag bouwt hij als Head of Strategy bij FamousGrey in nauw overleg met creatieven, designers & technologische experts aan slimme merkstrategieën die recht op doel afgaan qua impact & effectiviteit.